The $390M A&E Acquisition That Just Split the Market in Two

Infrastructure Catalyst

Issue #2 | December 22, 2025

Read Time: 3 minutes.

Welcome, infrastructure Professionals.

You're in the final week of 2025 closing out projects, finalizing budgets, and hitting year-end deadlines. While you're managing the close, the market just signaled what 2026 demands. Here's what you need to know.

📡 The Last Big Move of 2025 Just Told You Everything About 2026

Three weeks ago, AECOM, the $16B global infrastructure giant, acquired Consigli for $390M. Not software. The entire AI startup.

For decades, software vendors buy AI startups and sell to engineering firms. Firms don't acquire the technology companies themselves. AECOM just burned that playbook.

Their CEO's assessment: 18 months ago, AI was an "existential risk." Now it's an "existential opportunity" and they should be "the disruptor."

So they bought the disruptor. And they're selling their construction management division to focus capital on AI-augmented advisory services.

What this signal for 2026:

Four trends converging: tariff-driven material costs at 40-year highs (25-30% effective rates, 50% on steel/aluminum), AI infrastructure boom (Project Stargate's $500B commitment), agentic AI platforms, and a talent crisis (499,000 workers needed, 41% retiring by 2031).

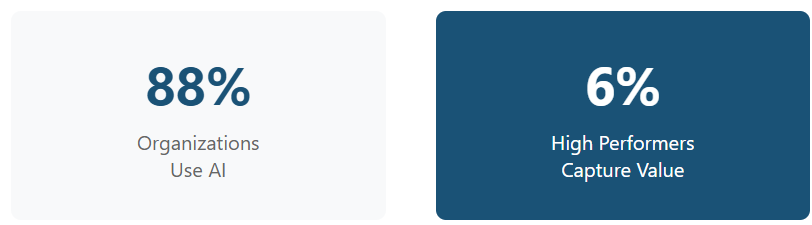

Deloitte's 2026 outlook says these forces separate high performers from the rest. BCG/MIT research shows the gap: 88% of organizations use AI, only 6% capture significant value.

The market isn't adopting AI uniformly. It's splitting into AI-native firms and everyone else.

🔧 What AECOM Actually Bought

Consigli brands itself as "The Autonomous Engineer," an AI agent automating MEP loadings, clash-free BIM, hydraulic calculations, tender documents, and plant room optimization. The company claims 90% reduction in engineering time.

AECOM didn't license technology. They acquired the capability itself. Consigli founder Janne Aas-Jakobsen becomes Head of AI Engineering.

Why This Forces a Choice:

AEC Magazine: "Startups are typically snapped up by software vendors rather than their customers... other AECO firms may feel compelled to behave more like tech companies or risk being pushed into commodity territory."

Engineering firms traditionally sold hours. AECOM is shifting to selling outcomes enabled by proprietary AI. Firms that own the AI layer control margins. Firms that don't compete on price for manual engineering work.

Other A&E responses: Mott MacDonald + Microsoft Azure AI, WSP Global, Jacobs, Stantec all face pressure to develop technology strategies rather than rely on third-party vendors.

📊 The 88% vs 6% Performance Gap

BCG/MIT research: 88% of organizations use AI, but only 6% capture significant value.

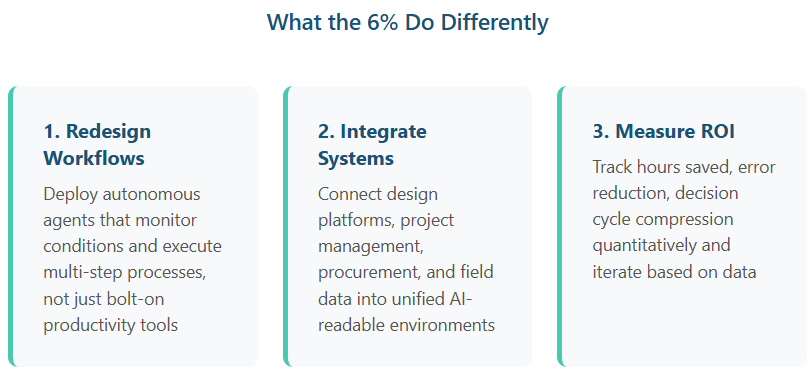

The difference: Low performers bolt AI onto existing workflows (ChatGPT for meeting notes, Copilot for emails). High performers redesign workflows around AI, deploying autonomous agents that monitor conditions and execute multi-step processes across integrated systems.

Example: Low performer uses ChatGPT to write weekly progress report (saves 30 min). High performer deploys agent pulling live data from Procore, P6, and cost systems, generating reports, flagging variances, and routing approvals automatically every Friday (saves 4 hours, improves accuracy).

The 6% aren't smarter. They're more systematic, treating AI deployment as an engineering problem, not a technology experiment.

⚡ Market Realignment: A&E vs Contractors

The Data Center Effect:

Project Stargate ($500B, 20 mega data centers, 10GW power) and parallel programs from Microsoft, Google, Amazon, Meta are creating a new category of premium-margin work requiring AI-enabled delivery.

A&E firms are splitting:

- AI-native: Acquire proprietary AI (AECOM model), deliver data center design at compressed timelines (90% faster MEP/BIM), premium margins

- Traditional: Compete for conventional infrastructure in price-sensitive markets

Contractors are splitting:

- Technology-enabled: Deploy AI for schedule optimization, automated coordination (Turner's 10,000-employee ChatGPT rollout), win data center work

- Traditional: Compete where lowest bid wins

Data center design requires power distribution at utility-grade scale, thermal management integration, accelerated timelines. When Consigli claims 90% time reduction, that's 3 weeks vs 6 months for preliminary design.

🔧 Tariff Response: AI Procurement

With steel/aluminum at 50% tariffs, 88.2% year-over-year increase in project abandonments, firms need predictive strategies.

AI platforms responding:

Field Materials AI (launched Dec 2025): Real-time dashboard tracking material prices with predictive analytics for when to lock in pricing.

Kinaxis: ML simulating "if you switched to this other part, what's the impact?"

Ivalua: AI agents forecasting risks, scenario planning, early warning on policy changes.

These monitor tariff policy, material indices, supplier lead times, alternative sources, then model: "If steel tariff increases 10%, which projects are most exposed?" Beam AI reports contractors using predictive procurement reduced steel price exposure by 12%.

Material costs are 50-60% of construction expenses. 3-5% optimization has outsized margin impact.

📡 INDUSTRY SIGNALS

Procore Helix Agent Builder: No-code agent creation using natural language. Pre-built RFI Creation Agent, Photo Intelligence. The "Power Automate moment" for construction AI.

Bentley "Plus" Generation: iTwin-native apps (OpenSite+, Synchro+) with specialized civil engineering agents for grading optimization, hydraulic calculations. Design workflows compressing from weeks to hours.

AI PM Market: $3.8B (2023) → $49.2B by 2030, 28.7% CAGR. Drivers: labor shortages, platform integration (Procore, Bentley, Autodesk embedding AI natively).

💬 READER QUESTION

Last issue's top pain points:

- Weekly progress reports - "4 hours Friday compiling from 6 systems"

- Submittal tracking - "Chasing approvals across reviewers"

- Daily field reports - "Superintendents documenting 90 min vs supervising"

Issue #3 tackles the most-voted item. Which helps you most? Hit reply.

Build systems, not stress.

Joseph Dib, PE, PMP | The Infrastructure Catalyst

P.S. Know a PM still treating AI like a personal productivity tool? Forward this before their competitors don't.